April 11, 2018

By: Anna Sayre, Legal Content Writer SanctionsAlert.com

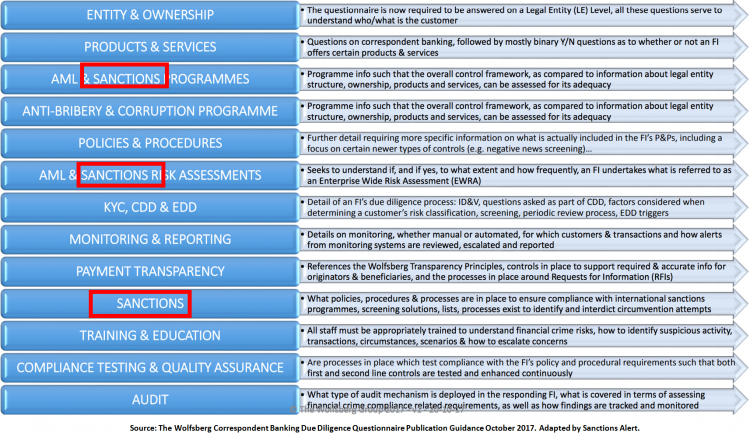

In direct response to increased regulatory expectations for enhanced due diligence in correspondent banking relationships, the Wolfsberg Group (Wolfsberg), published its new Correspondent Banking Due Diligence Questionnaire (CBDDQ) in February 2018, incorporating a number of important changes. The new Questionnaireis not only four times as long as its 2014 predecessor, containing 110 instead of 28 questions, but has also expanded its scope to specifically address due diligence issues relating to Anti-Bribery and Corruption, Counter terrorism Financing,and Sanctions exposure controls.

Alongside the Questionnaire, Wolfsberg, a group of thirteen global banks, has also published Completion Guidance, FAQs, and a Glossary of terms.

According to Wolfsberg’s website and its Publication Guidance, the new CBDDQ“aims to set an enhanced and reasonable standard for cross-border and/or other higher risk Correspondent Banking Due Diligence”. Wolfsberg hopes that “the adoption of a standardised, reasonable CBDDQ should engender a less arduous, and thereby inherently less costly, due diligence process for Correspondent Banks”.

The Evolution of Wolfberg’s DDQs

The Questionnaire provides an overview of a financial institution’s anti-money laundering policies and practices. The answers are typically prepared by a smaller bank for the benefit of larger correspondent banks. In the correspondent banking system, small banks typically keep balances with larger banks and, in return, receive various services from the big banks, including processing of transactions in U.S. dollars.

Wolfsberg published its first Correspondent Banking principles in 2002, followed by its first anti-money laundering (AML) Questionnaire in 2004, which was comprised of 27 questions. The main purpose of the 2004 DDQ was to “act as an aid to FIs conducting due diligence on Correspondent Banking relationships”.

In February 2014, Wolfsberg revised the 2004 DDQ to include an additional question on training (Q24), bringing the total number of questions to 28.

In 2015, the Financial Action Task Force (FATF) published a statement on risk, emphasizing the trend to lower risk was continuing and that further work was required. In October of the same year, the Committee on Payments and Market Infrastructures (CPMI), an international standard setter for financial transaction monitoring of which over 30 federal banks are a member,published a Consultative Report on Correspondent Banking which recommended that, “relevant stakeholders (e.g. the Wolfsberg Group) review the templates and procedures used by the different utilities… to compile a data set that all utilities should collect as best practice.” In addition to CPMI’s Report, FATF published its own Guidance on Correspondent Banking Services in 2016, in which it expressed its view that “not all correspondent banking relationships carry the same level of money laundering or terrorist financing risks, hence any enhanced due diligence measures have to be commensurate to the degree of risks identified”.

In response to these findings by the FATF, CPMI and others, Wolfsberg committed itself to creating the new and enhanced CBDDQ.

Expert Opinion from the Compliance Community

We asked a expertsin the industry, bothin the U.S. and abroad, what they thought of Wolfsberg’s new CBDDQ, if the CBDDQ wouldbetter help compliance officers satisfy their requirements, and how the CBDDQ could help (if at all) to enhance sanctions compliance.

A ‘Better Reflection’ of Compliance Guidelines

Ms. Debra Geister, Managing Director ofAML Advisory Services at compliance firm Matrix IFS in New York tells us she thinks “the new questionnaire is an update of standards and more importantly, regulatory expectations in correspondent banking”. She adds that,“I believe the new version will be a better reflection of a best practices guideline for correspondent banking and also align more with regulatory expectations”.

Mr. Gert Demmink, Partner at Dutch compliance firm – Philip Sydney – mirrors Ms.Geister’s comments insofar as“the questionnaire is now more in line with the current standards”. Mr. Demmink also believes the CBDDQ “will further demand analytical skills of people handling these questionnaires, as there are a lot of questions which have to be addressed, analyzed and (if required) updated”. “This will impact the day to day activities”, he adds.

More Thoughtful Analysis; Less Operational Burden

As to how the new CBDDQ can help compliance officers fulfill their daily duties, Mr. Demmink believes that “the questionnaire requires thoughtful analysis of the given answers, so it will require you to step out of the checklist approach”. He goes on to mention that “the questionnaire gives you additional information, which has to be measured alongside your internal policies and procedures and forces you to consider the question: does it fit your risk appetite?”.

Ms. Geister of Matrix IFS believes the biggest benefit of the questionnaire is operational in that it should “minimize the operational burden on staff by allowing the bank to fill out the form once and then it can be shared across organizations.” She also believes that, “for the Section 319 (correspondent certification) process in the U.S., the questionnaire becomes a good foundation for review of the correspondent program”. “It is not meant to be all encompassing or comprehensive, but it should create a good framework for identifying and assessing risk”, she adds.

A ‘Good Aid’ to Sanctions Compliance

The new CBDDQ includes several sanctions-related questions, such as:

- Does the Entity have a Sanctions Policy approved by management regarding compliance with sanctions law applicable to the Entity, including with respect its business conducted with, or through accounts held at foreign financial institutions?

- Does the Entity have policies, procedures, or other controls reasonably designed to prevent the use of another entity’s accounts or services in a manner causing the other entity to violate sanctions prohibitions applicable to the other entity (including prohibitions within the other entity’s local jurisdiction)?

- Does the Entity have policies, procedures or other controls reasonably designed to prohibit and/or detect actions taken to evade applicable sanctions prohibitions, such as stripping, or the re submission and/or masking, of sanctions relevant information in cross border transactions?

- Does the internal audit function or other independent third party cover Transaction Screening including for sanctions?

- Has the entity documented procedures consistent with applicable AML, CTF & Sanctions regulations and requirements to reasonably prevent, detect and report sanctions violations?

- Does the Entity’s Sanctions Enterprise-Wide Risk Assessment (EWRA) cover the inherent risk components detailed below: Client, Product, Channel, Geography?

- Has the Entity’s Sanctions EWRA been completed in the last 12 months?

- Does the Entity’s Sanctions EWRA cover the controls effectiveness components detailed below: Customer Due Diligence, Transaction Screening, Name Screening, List Management, Training and Education, Governance, Management Information?

- When new entities and natural persons are added to sanctions lists, how many business days before the Entity updates its lists?

As to whether or not the new CBDDQ will have any affect on the sanctions compliance industry in particular, Mr. Demmink of Philip Sydney thinks that, though not specifically targeted to aid in sanctions compliance, “the Questionnaire may give additional and useful information with regard to sanctions related topics”.

Ms. Geister also believes the CBDDQ could be of some use to sanctions professionals as it “will definitely help with correspondent reviews and certifications as well as with the Customer Due Diligence and KYC programs and the changes may prompt institutions to look closer at their current sanctions program”.“Anytime we can review and assure our programs are comprehensive and consistent it is a positive action”, she emphasizes.