Recent Up Tick in Number of OFAC Enforcement Actions against IT/telecom, Offshore Services; California, New York and Texas Companies Most At Risk

October 20, 2017

By Anna Sayre, SanctionsAlert.com

Are you a business that thinks OFAC only takes action against New York-based financial institutions? Think again.

Since 2014, OFAC enforcement actions have significantly increased against non-financial institutions, particularly in IT/telecom and offshore services industries. Furthermore, in addition companies in New York, those in Texas, and especially California, remain highly at risk.

These are some of the conclusions from an analysis of OFAC enforcement actions conducted by SanctionsAlert.com last month.

All information contained in OFAC settlement agreements – such as: industries targeted, sanctions program violated, and other data – provides valuable information that businesses can use to construct their OFAC compliance program and improve their risk mitigation strategies. It is generally important to take the time to reflect and learn from the mistakes of others.In the case of OFAC actions and penalties, this rings doubly true.

This article focuses on which type of companies and financial institutions are most at risk.

IT/Telecom and Offshore Services

Since 2014, the IT/telecom sector saw an increase from 4% to 17% of the total number of enforcement actions. This included the case against ZTE, a Chinese telecom, which paid $1.19 billion in March 2017. This was the largest amount ever paid in a settlement against a non-financial institution for alleged sanctions and export controls violations, and involved Department of Treasury’s OFAC, Commerce Department Bureau of Industry and Security, and Department of Justice.

Other IT/telecom companies hit with an OFAC enforcement action since 2014 included CSE Global Limited from Singapore, Barracuda Networks Inc., with offices in? incorporated in? California and the United Kingdom, and web developer Blue Robin, Inc. from Massachusetts.

The rise in enforcement actions against the offshore services industry made an even bigger jump from 0% in 2014 to 17% in 2017. Offshore services companies that felt the wrath of OFAC included CGG Services S.A. from France, Halliburton with a presence in United States and the Cayman Islands, National Oil well Varco, Inc. from Texas, Aban Offshore Limited from India, and COSL Singapore Ltd.

Table: Percentage of OFAC Enforcement Actions in Selected Non Financial Sectors vs. Total Number of OFAC Enforcement Actions

| 2014 | 2015 | 2016 | 2017 (until September 5, 2017) | |

| IT/Telecom | 4% | 12% | 0% | 17% |

| Medical/Pharmaceutical | 0% | 0% | 22% | 8% |

| Non Profit Institutions | 0% | 5% | 0% | 8% |

| Offshore Services | 0% | 6% | 33% | 17% |

| Oil & Gas | 0% | 0% | 0% | 8% |

| Professional Services Sector | 0% | 0% | 11% | 8% |

OFAC Actions Against Financial Institutions Down; Mainly Targeting Non-Banks

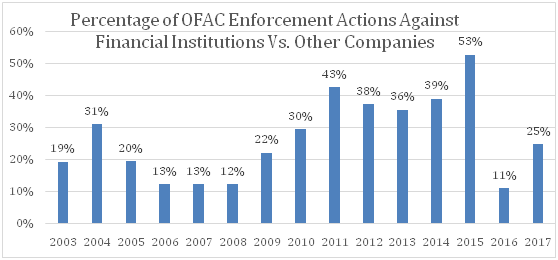

Whereas two years ago, the percentage of all OFAC enforcement actions against financial institutions (such as: banks, finance companies, insurance, pension funds, etc.) was at a record-high of 53%, in 2017, the financial sector was only targeted in 25% of all OFAC enforcement cases.

The lowest percentage was measured in 2016, when only 11% of all OFAC enforcement actions targeted the financial sector. This particular year could be considered as a fluke however as, from 2010 to 2015, actions against financial institutions made up an average of 39.8% of the total actions each year for that five-year period.

Interestingly, in 2017, two out of the three OFAC enforcement actions against financial institutions did not involve traditional banks.The actions were against American International Group, Inc., an insurer and America Honda Finance Corporation, a car finance company.

USA-Based Entities Top The List

Overall, since 2003, when OFAC started publishing its enforcement actions on its website and excluding individuals, the U.S.A. continues to top the list by far by bringing a total of 647 actions against entities. The U.K. and the Netherlands tied for second place with a total of seven actions each.

Table: Top 5 Countries: Actions taken 2003-September 5, 2017

| Country | Target |

| USA | 647 |

| Netherlands | 7 |

| UK | 7 |

| Canada | 4 |

| Mexico | 3 |

| UAE | 3 |

Since 2003, on average, 81% of all enforcement actions each year were brought against U.S. -based entities (versus foreign or mixed U.S./foreign-based entities).

In only two years 100% of the actions were against U.S- based entities: In 2003 and 2011.

We look at the trend over the last five years, we see that the percentage of OFAC enforcement actions against U.S. companies versus foreign-based companies has declined from 82% in 2013 to 58% in 2017.

| Year | Percentage of Enforcement Actions

Against US-based entities[1] Versus the Total |

| 2013 | 82% |

| 2014 | 64% |

| 2015 | 71% |

| 2016 | 44% |

| 2017 | 58% |

Since 2003, OFAC enforcement actions only once targeted less U.S.-based entities than foreign-based entities, namely in 2016, with 44%.

Companies in California, New York and Texas At Greater Risk

Looking at a trend with regard to U.S. states where the target was located, over the last 10 years, SanctionsAlert.com noticed that California, Texas, and Florida based companies appear to be at highest risk of an OFAC enforcement action being brought against them.

Most notably, California is at a record-high. In 2017, a whopping 43% of the all OFAC enforcement actions were against companies based in this state.

[1] Does not include enforcement actions against entities that had both USA and foreign presence.

| Year | Nr. 1 State Where Targets of OFAC Enforcement Actions Were Based (Based on Number of Actions) | % (of the total of) Enforcement Actions |

| 2007 | CA | 21% |

| 2008 | CA | 19% |

| 2009 | TX | 26% |

| 2010 | FL | 20% |

| 2011 | NY | 25% |

| 2012 | WA | 18% |

| 2013 | CA | 39% |

| 2014 | CA | 36% |

| 2015 | NY | 25% |

| 2016 | TX | 25% |

| 2017 | CA | 43% |

The next article in this series will analyze the amounts paid to OFAC (penalties or settlement), by sanctions program violations (e.g. Iran, Cuba or WMD proliferation finance), and other factors such as whether the missteps were voluntarily disclosed or not.