November 20, 2020

By: Amir Fadavi Ardekani, BNP Paribas*

In recent times, the U.S. Government has not been shy about imposing sanctions on activities with no nexus to the U.S. in order to increase its global crack down. The imposition of these so-called ‘secondary sanctions’ have resulted in an even further global reach of OFAC restrictions and rules.

But what is the difference between primary and secondary sanctions, and when do they apply to foreign persons/institutions?

Although there is no single agreed-upon definition for primary and secondary sanctions, many would agree that primary sanctions are those which only can be imposed when a nexus to the U.S. exists, while secondary sanctions are those which can be imposed regardless of a U.S. nexus. This definition, although helpful, can be misleading as it often raises some concerns about the true extraterritoriality of U.S. secondary sanctions.

In order to avoid such confusions and concerns, it may be helpful to view sanctions based on the underlying activity that is being restricted, rather than whether that activity has a U.S. nexus. In other words, whether that activity is prohibited or is merely sanctionable.

The Applicability of Primary sanctions, or ‘Prohibited’ Activity

An activity is ‘prohibited’ when an authority could enforce the prohibition against one who engaged in such activity. In other words, an act is prohibited if by engaging in it a person could be civilly or criminally liable. For this type of activity, the U.S. Government can only exercise its jurisdiction over ‘U.S. persons’. This includes U.S. citizens and permanent resident aliens regardless of where they are located, all persons and entities within the United States, all U.S. incorporated entities and their foreign branches (and in certain programs, foreign subsidiaries owned or controlled by U.S. companies). The vast majority of sanctions fall into this category of prohibited activity and does not apply to non-U.S. persons or foreign entities.

If a non-U.S. person was to be deemed liable for prohibited activity, it would only be if that non-U.S. person caused a U.S. person to be involved in such activity. For instance, the U.S. Government may be able to claim jurisdiction over a non-U.S. financial institution if they were to use a U.S. financial institution to clear a U.S. dollar transaction which would have been prohibited for that U.S. financial institution to engage in.

The Three Types of Secondary Sanctions, or ‘Sanctionable’ Activity, that Need No U.S. Nexus

An activity is considered ‘sanctionable’ when it is not prohibited, however, could result in restrictions for a person who knowingly conducts such activity. Although such restrictions are designed to negatively affect a non-U.S. person who knowingly engages in a sanctionable activity, they in fact limit the ability of U.S. persons in doing busienss with those non-U.S. persons (e.g. limitations on U.S. Persons to provide certain financial services to that non-U.S. person). It is important to note that in this case, the non-U.S. person who knowingly conducted a sanctionable activity would be neither criminally nor civilly liable per U.S. sanctions laws. For example, if a person provides material support for certain listed persons then the person who provided material support could be punished by being added to the SDN list of the United States Treasury which is not a criminal sentence or civil penalty, but an administrative action of the United States Government.

In general, sanctionable activities fall into three types:

- Activities that provide material support for certain sanction targets (e.g. section (D) (1) of Executive Order 13692),

- Activities that materially contribute to certain targeted activities by the U.S. Government (e.g. section 1. (a)(iii) of Executive Order 13949), and

- Significant transactions with certain listed persons (e.g. section 1. (b) of Executive Order 13886) or in certain activities (e.g. section 1. (ii) of Executive Order 13902).

Restrictions put in place by the U.S. Government vary depending on the sanctions program, which can range from being added to OFAC’s Specially Designated Nationals (SDN) List to losing the ability to use U.S. correspondent banking services, and/or exclusion from certain procurement contracts. As such, it is important to see how these potential restrictions could affect a non-U.S. person. If none of those restrictions could have a considerably negative effect on a non-U.S. person then that person might choose to engage in a sanctionable activity.

Differing Objectives

Another way to highlight the difference between prohibited activities as opposed to sanctionable one is to look at the policy objectives behind such measures.

As the disagreements among countries about the scope of sanctions has increased, one way for the U.S. Government to ensure its sanctions have the intended effect is to deter actors over whom it has no jurisdiction from engaging in activities which would offset the effectiveness of existing U.S. sanctions. This is done by making some activities sanctionable rather than prohibiting them. In other words, sanctionable activities are not primarily against U.S. foreign policy goals (e.g. terrorism, malicious cyber activity, regional influences, and human rights violations); rather they are activities that secondarily help a U.S. primary sanction targets by nullifying the intended negative economic pressure caused by the U.S. prohibitions for U.S. persons.

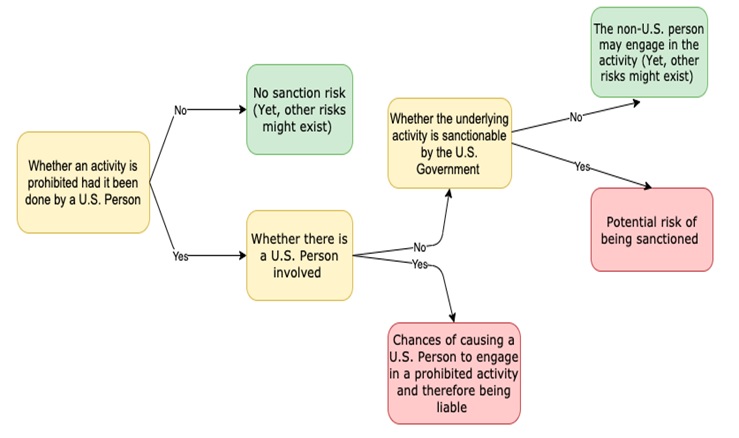

A Step-by-Step Approach to Assess the Risk

A non-U.S. person can assess the risk of potential sanctions breaches by following the below steps:

Initially, it should be determined whether an activity is prohibited had it been done by a U.S. person. If the response to this question is negative, then the activity does not bear the risk of breaching the U.S. sanctions or in other words, it may not be considered as a sanctionable activity if conducted by non-U.S. persons. If; however, the response to this question is affirmative, then a non-U.S. person needs to ask another question.

The second question is whether there is a U.S. person involved in the activity or in the transactions related to that activity. If the response to this question is affirmative, then the non-U.S. person could cause a U.S. person to be in breach of the U.S. sanctions laws and therefore, the non-U.S. person could be liable itself.

In contrast, if the response to the second question is negative, then the non-U.S. person should ask yet another question as to whether the underlying activity is sanctionable by the U.S. Government or not. If not, then the non-U.S. person might engage in that activity without the risk of U.S. sanctions. However, if the response to the last question is yes, then the non-U.S. person should assess the risk associated with that activity based on the type of sanction that could be attached to the activity and the exposure such non-U.S. person has to the U.S. and U.S. persons.

Additional Points to Consider when Engaging in Sanctionable Activity

In assessing the risks associated with getting engaged in a sanctionable activity, a non-U.S. person needs to keep a few points in mind.

- ‘Knowlingly’: The term “knowingly”, with respect to conduct, a circumstance, or a result, means that a person has actual knowledge, or should have known. Therefore, a non-U.S. person might be negatively affected by engaging in a sanctionable activity even without actual knowledge of the conduct targeted by the U.S. Government. Having said that, as of the date of this publication, the author is not aware of any case in which the U.S. Government acted on mere reasons to know for sanctioning a person.

- ‘Significant’ Transactions: For some sanctionable activities OFAC used the term significant transaction. OFAC has a number of FAQs (for example FAQs 683, 671, and 542) that define significance based upon a number of factors including:

- size, number, and frequency; type, complexity and commercial purpose;

- the level of awareness or involvement by the bank’s management;

- whether the activity or payment illustrates a pattern of practice or is an isolated event;

- the ultimate economic benefit conferred upon the designated person(s); the impact of the transaction(s) on statutory objectives;

- whether the transactions involved the use of deceptive financial practices to obscure the identities of the parties involved; and

- other factors that the Secretary of the Treasury deems relevant on a case-by-case basis.

Therefore, a non-U.S. person should take into account several factors, not only the value of a transaction, engaging in sanctionable transactions.

- Other Risks: When engaging in an activity with a sanctioned target, even if the activity is permissible or non sanctionable, there might be other pitfalls involved including: money laundering risk, corruption concerns, reputational risk, as well as unwanted difficulties in relationships with other non-U.S. persons who are reluctant to engage in any indirect activity with a sanctions target.

- General Liscenses not Applicable: The U.S. Government has put in place several general licenses with regard to certain sanctions regimes. Most of these licenses are only applicable to U.S. persons. In other words, a non-U.S. person might not necessarily be able to rely on them.

*Amir is a Sanctions Specialist within BNP Paribas’ Compliance Department in Paris. Amir advises on applicability of U.S. sanctions in the European market of the bank. He also advises on matters related to E.U. restrictive measure.

T (+33)632649443| Linked In: https://www.linkedin.com/in/amir-fadavi-ardekani-4b7991118/